ev charger tax credit form

Complete your full tax return then fill in form 8911. Federal tax credit gives individuals 30 back on a ChargePoint Home Flex EV charger and installation costs up to 1000.

2021 Honda E 高清图片 视频 规格和信息 Dailyrevs Charger Car Electric Car Charger Ev Charger

The credit is computed and reported on IRS Form 8911.

. The credit attributable to depreciable property refueling property used for business or investment purposes is treated as a general business credit. Youll need to fill out the IRS Form 8936 for the Qualified Plug-in Electric Drive Motor Vehicle Credit. If you purchased a new vehicle that runs on electricity drawn from a plug-in rechargeable battery you may be eligible to claim the qualified plug-in electric drive motor vehicle tax credit which can reduce your tax bill.

State-based EV charger tax credits and incentive programs vary widely from state to state. Qualifications for the Vehicle Conversion to Alternative Fuels or Electric Vehicle Charger Tax Credits. You must have purchased the vehicle in 2012 or 2013 and begun using it in the year in which you claim the credit.

Make sure to keep receipts for the equipment and installation of your EV charger. Residential Energy Credits Form 5695 Part I then. About Form 8911 Alternative Fuel Vehicle Refueling Property Credit.

For more information please contact your BNN tax advisor at 8002447444. Alternative Fuel Vehicle Refueling Property Credit Form 8911. The charging station must be purchased and installed.

And Schedule K-1 Form 1120-S Shareholders Share of Income Deductions Credits etc box 13 code P. You can receive a tax credit of up to 30 of your commercial electric vehicle supply equipment infrastructure and installation cost or up to 30000. Qualified Plug-in Electric Drive Motor Vehicle Credit Personal use part Form 8936 Part III.

January 2022 Department of the Treasury Internal Revenue Service. Form 6251 is for AMT and is has the calculated TMT or Tentative Minimum Tax. Alternative Fueling Infrastructure Tax Credit State EV Charging Incentive.

For tax years beginning before January 1 2020 a tax credit is available for up to 75 of the cost of installing commercial alternative fueling infrastructure. In order to take the credit you must file IRS Form 8936 with your return and meet certain requirements. The important thing is not to overlook incentives for buying the EV charging station which is a critical component of a convenient and enjoyable EV ownership experience.

The federal government offers a tax credit for EV charging stations known as the Alternative Fuel Infrastructure Tax Credit for equipment and installation costs. About Form 8936 Qualified Plug-In Electric Drive Motor Vehicle Credit. The actual tax credit amount varies on different EV models.

For instructions and the latest information. Receive a federal tax credit of 30 of the cost of purchasing and installing an EV charging station up to 1000 for residential installations and up to 30000 for commercial installations. Use this form to figure your credit for alternative fuel vehicle refueling property you placed in service during your tax year.

Electric vehicle chargers - 10 of the cost of the charger and its installation or 2500 whichever is less. A battery-electric vehicle BEV with a rating of 25 kWh per 100 miles costs approximately 375 dollars per year or 3125 per month to charge at a rate of 10 cents per kWh. The Vehicle Conversion to Alternative Fuel and the Electric Vehicle Charger tax credits are still available.

Funded by the California Energy Commission CEC and implemented by the Center for Sustainable Energy CSE the Southern California Incentive Project SCIP promotes access to electric vehicle EV charging infrastructure by offering rebates of up to 80000 for the purchase and installation of eligible public electric vehicle EV chargers in Los Angeles Orange. If you purchased your EV more than 3 years ago and the vehicle is still eligible for the tax credit you can file an amended return to claim your credit. Youll need to know your tax liability to calculate the credit.

Its subject to TMT whereas other credits like The EV car credit and Solar credits arent. Partnerships and S corporations report the above credits on line 8. This publication is intended to provide general information to our clients and friends.

This form walks you through reporting your expenses for the project and calculating your credit. Schedule K-1 Form 1065 Partners Share of Income Deductions Credits etc box 15 code P. You can also review the guidance from the IRS at this site IRS Guidance 8911 or consult your tax advisor.

Were EV charging pros not CPAs so we recommend getting advice from your own tax professional. The credit is 10 of the purchase price. Federal EV Charging Tax Credit.

Basically if you have enough credits for the year even if you still have tax liability and no AMT your TMT will dictate if you will get the EV Charger credit. Figured it out. It covers 30 of the costs with a maximum 1000.

For the federal tax credit youll need to submit IRS Form 8911 when you file your business taxes. Just buy and install by December 31 2021 then claim the credit on your federal tax return. Previously this federal tax credit expired on December 31 2017 but is now extended through December 31 2021.

How do I apply for a tax credit for installing electric-vehicle charging stations. Attach to your tax return. Also use Form 8936 to figure your credit for certain qualified two- or three-wheeled plug-in electric vehicles.

So after your Form 8936 credit is applied to tax any amount of tax remaining will be offset by your Residential Energy Credit. Alternative Fuel Vehicle Refueling Property Credit. EV Charging Incentives by State.

The federal government offers a tax credit for EV charger hardware and EV charger installation costs. You claim the credit on your Federal tax return by completing a form 8911 see the form here. You may be eligible for a credit under section 30D g if you purchased a 2- or 3-wheeled vehicle that draws energy from a battery with at least 25 kilowatt hours and may be recharged from an external source.

Federal EV Charger Incentives. Enter 100 unless the vehicle was manufactured by Tesla or General Motors Chevrolet Bolt EV etc To claim your federal EV tax credit you must fill out Form 8936 along with Form 1040. Youll need to know your tax liability to calculate the credit.

Any credit not attributable to. Grab IRS form 8911 or use our handy guide to get your credit. IRS Form 8911 and it provides a tax credit of 30 up to 1000 of the purchase and installation cost of.

You attach this form to your federal tax returns and send it in at the time of filing your annual income taxes. Enter total alternative fuel vehicle refueling property credits from. Use Form 8936 to figure your credit for qualified plug-in electric drive motor vehicles you placed in service during your tax year.

Ev Charging Stations 101 Wright Hennepin

Best Level 2 Ev Charger Compare Chargepoint Juice Box Grizzl E Siemens Blink More

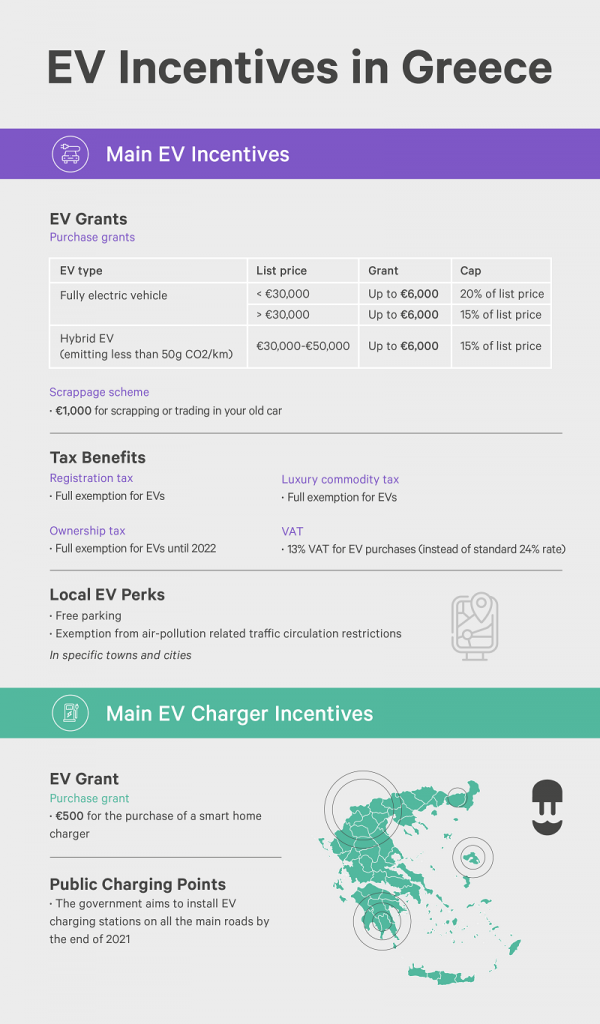

Ev Ev Charging Incentives In Greece A Complete Guide Wallbox

How Batteries Can Bridge The Ev Infrastructure Gap Greentech Media Infrastructure Gap Electric Vehicle Charging

How To Choose The Right Ev Charger For You Forbes Wheels

Electric Car Charger Ev Charger Charger Car

Blink Ecotality By Frog Design Machine Design Id Design Ev Chargers

What Are The Different Levels Of Electric Vehicle Charging Forbes Wheels

Xaper Electric Vehicle Charging App Figma Ui Design By Wordpress Studio

About Electric Vehicle Charging Efficiency Maine

Commercial Ev Charging Incentives In 2022 Revision Energy

Here S Everything You May Want To Know About Umweltbonus Genannt Purchase Premium For E Cars The So Called Env Electric Cars Incentive Used Electric Cars

Nio Nio Power Ev Charger Environmental Design Stainless Steel Texture

Rebates And Tax Credits For Electric Vehicle Charging Stations

Tax Credit For Electric Vehicle Chargers Enel X

4 Things You Need To Know About The Ev Charging Tax Credit The Environmental Center

Electric Vehicle Charger Installation

Home Charging For E Mobility Designed By Kiska On Behance Station De Charge Electronics Projects Voiture Electrique